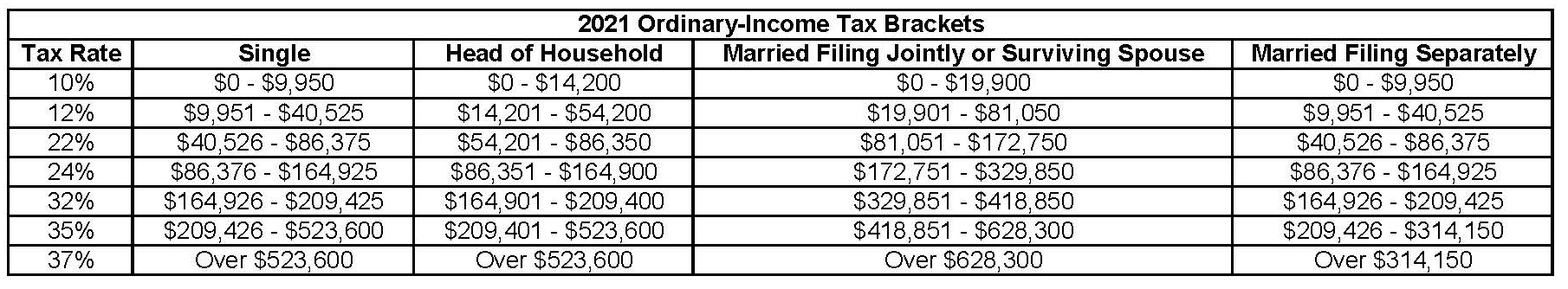

2021 Ira Contribution Limits Married Filing Jointly

Anyone earning less than 125 000 per year or married couples earning up to 198 000 and filing jointly will be able to contribute the maximum amount to a roth ira in 2021 a slight increase.

2021 ira contribution limits married filing jointly. If you re 50 or older you get a 1 000 catch. And you cannot make deductible contributions at all once your income exceeds. 2021 roth ira income limits.

105 000 to 125 000 married couples filing jointly. In 2021 the agi phase out range for taxpayers making contributions to a roth ira is 198 000 to 208 000 for married couples filing jointly up from 196 000 to 206 000 in 2020. This applies when the spouse making the ira contribution is covered by a workplace retirement plan.

Filing status modified agi contribution limit. Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional iras by the result. If you re under 50 you can put in up to 6 000 in 2021.

196 000 in 2020 198 000 in 2021 206 000 in 2020 208 000 in 2021 married filing. Catch up contributions for savers who will be 50 or older by the end of 2021 let them save up to 7 000. Ira contribution limits for traditional and roth accounts in 2021 will be the same as 2020 s.

6 000 7 000 if you re age 50 or older. In 2021 eligibility to contribute to a roth ira starts to phase out at 125 000 for single filers and 198 000 for married couples filing jointly. The ira contribution limit for 2021 is 6 000 or your taxable income whichever is lower.

Divide the result in 2 by 15 000 10 000 if filing a joint return qualifying widow er or married filing a separate return and you lived with your spouse at any time during the year. 0 to 10 000 married filing a separate return. Those are slightly higher starts of the phase out thresholds than in 2020 which began at 124 000 for single individuals and 196 000 for married couples.