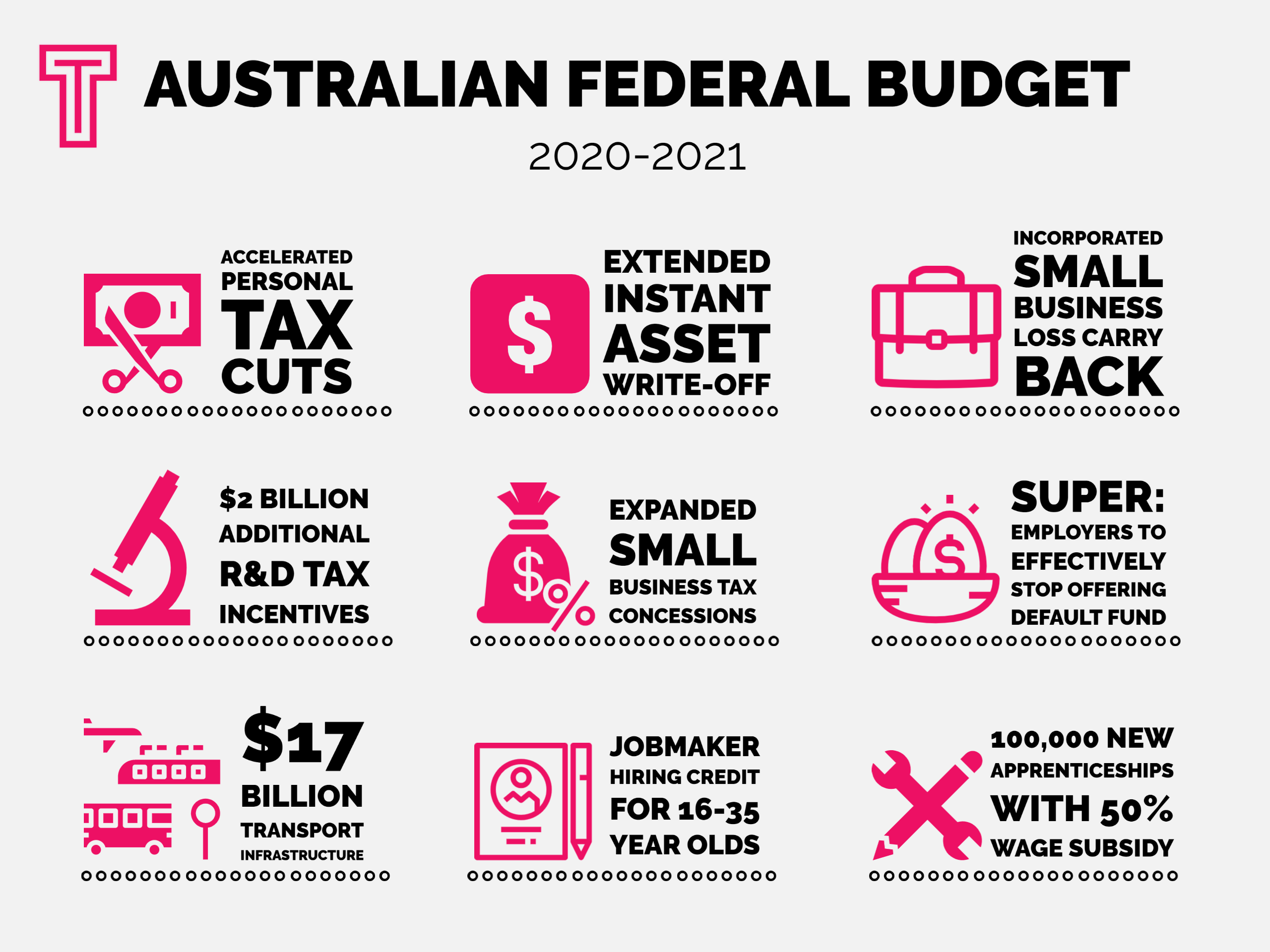

2021 Income Tax Rates Australia

29 467 plus 37 cents for each 1 over 120 000.

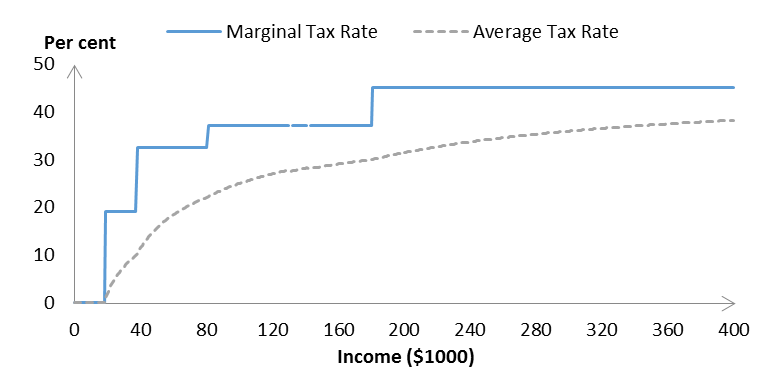

2021 income tax rates australia. 19c for each 1 over 18 200. The tax free schedule is due to stay at 18 200 until at least 2024 25. The tax free threshold may effectively be higher for taxpayers eligible for the low income tax offset the seniors and pensioners tax offset and or certain other tax offsets.

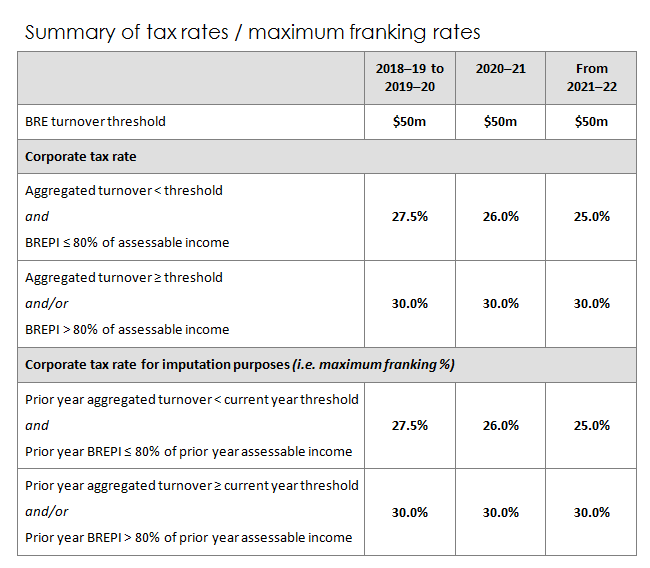

29 467 plus 37c for each 1 over 120 000. The 19 rate ceiling lifted from 37 000 to 45 000. Personal income tax rate in australia averaged 45 44 percent from 2003 until 2020 reaching an all time high of 47 percent in 2004 and a record low of 45 percent in 2007.

19 cents for each 1 over 18 200. Tax rates 2020 2021. Make sure you click the apply filter or search button after entering your refinement options to find the specific tax rate and code you need.

Increasing the top threshold of the 19 personal income tax bracket from 37 000 to 45 000 providing up to 1 080 in tax relief. Tax on this income. 5 092 plus 32 5 cents for each 1 over 45 000.

The personal income tax rate in australia stands at 45 percent. Later phases will change the thresholds for when the 32 5 and 37 marginal tax rates apply and eventually remove both of those marginal tax rates which will result in around 94 of australian taxpayers facing a marginal tax rate of 30 or less in the 2024 25 and later income years. 51 667 plus 45 cents for each 1 over 180 000.

The 32 5 tax bracket ceiling lifted from 90 000 to 120 000. Increasing the threshold of the 32 5 tax bracket from 90 000 to 120 000 providing up to 1 350 in tax relief. Low and middle income tax offset in 2021 you may be eligible for a tax offset in 2021 if you are a low or middle income earner and you are an australian resident for income tax purposes.