2021 Income Tax Rate Malaysia

This page provides malaysia personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

2021 income tax rate malaysia. For those earning rm50 000 to rm70 000 a year the income tax rates 2021 personal tax rates 2021 lower by 1 point. With the negative impact of the pandemic on the malaysian market the government has consider providing temporary tax breaks to individual taxpayers who have suffered salary reductions or job losses. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate.

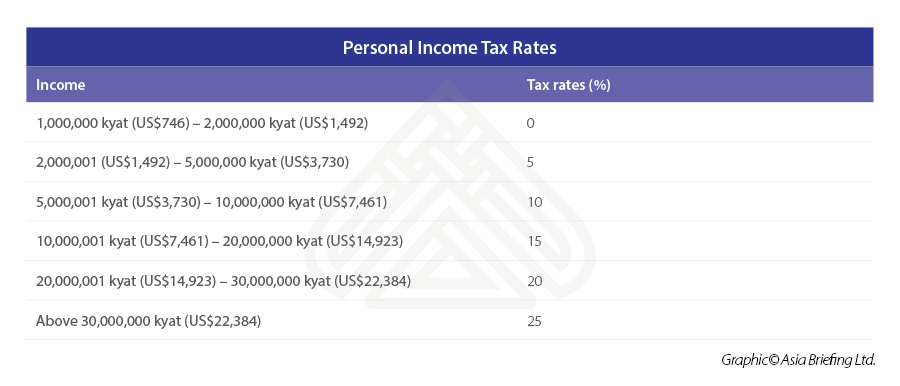

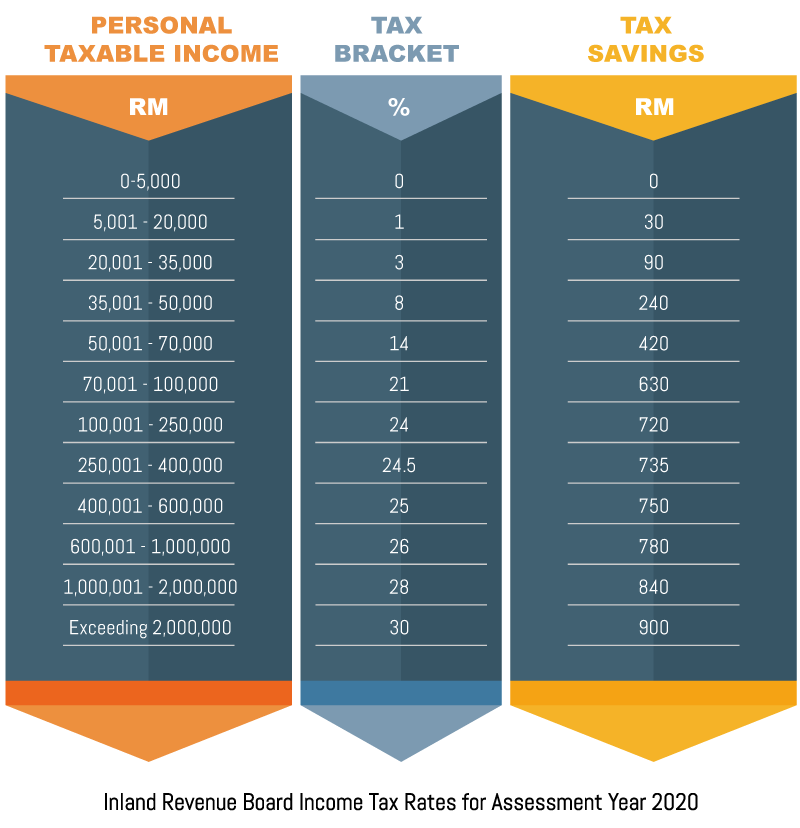

Personal income tax rate in malaysia averaged 27 29 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. For the assessment year 2020 there is an additional range of taxable income that is for taxable income in excess of rm2 million. The personal income tax rate in malaysia stands at 30 percent.

Tax measures proposed in the 2021 budget include. No other taxes are imposed on income from petroleum operations. The general corporate income tax rate in malaysia is 24 the incentives would be available for applications received by the malaysian investment development authority mida up to 31 december 2022 for companies in the manufacturing sector and for applications received by the mida from 7 november 2020 up to 31 december 2022 for companies in.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. The government has agreed to lower the rate for individual income tax by one percentage point for those earning taxable wages from rm50 001 to rm70 000 which is expected to benefit 1 4 million taxpayers said tengku zafrul.

Income tax rates 2021 malaysia. Kuala lumpur nov 6 the government announced reduced rates for income tax as part of budget 2021 tabled in parliament today by finance minister datuk seri tengku zafrul abdul aziz. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia.

This page is also available in. 2020 2021 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. This booklet also incorporates in coloured italics the 2021 malaysian budget proposals announced on 6 november 2020 and the finance bill 2020.