2021 Income Tax Brackets Uk

2021 federal income tax brackets and rates in 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

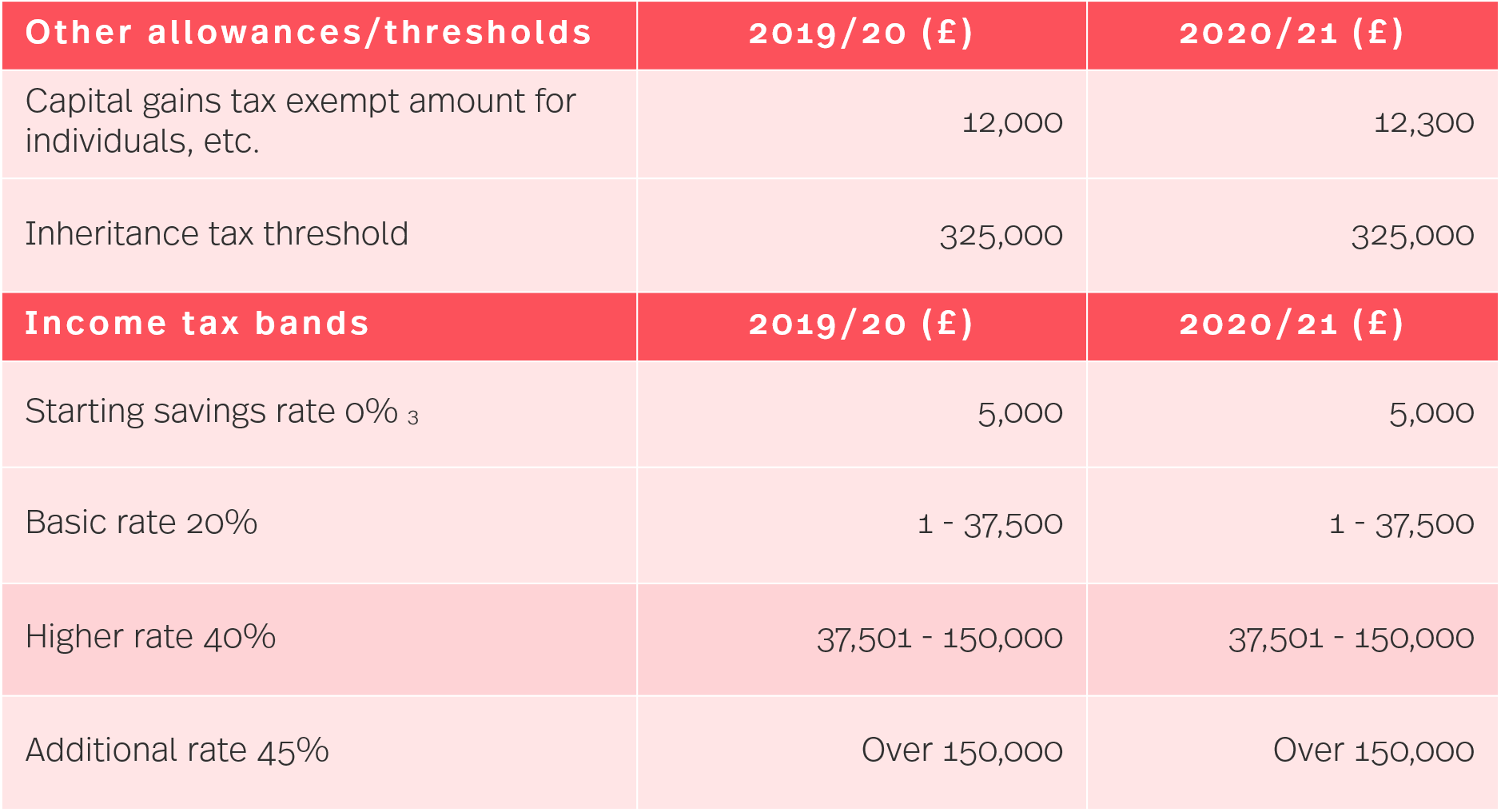

2021 income tax brackets uk. 2020 2021 tax rates and allowances. Income limit for personal allowance. Paye tax rates and thresholds 2020 to 2021.

There are low income and other full or partial medicare exemptions available. Chancellor confirms increases to income tax personal allowance and higher rate thresholds and ni limits and thresholds for 2021 22 25 november 2020 within the spending review accompanying documents it has been confirmed that both the income tax personal allowance and higher rate threshold will increase in line with the consumer price index. Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018.

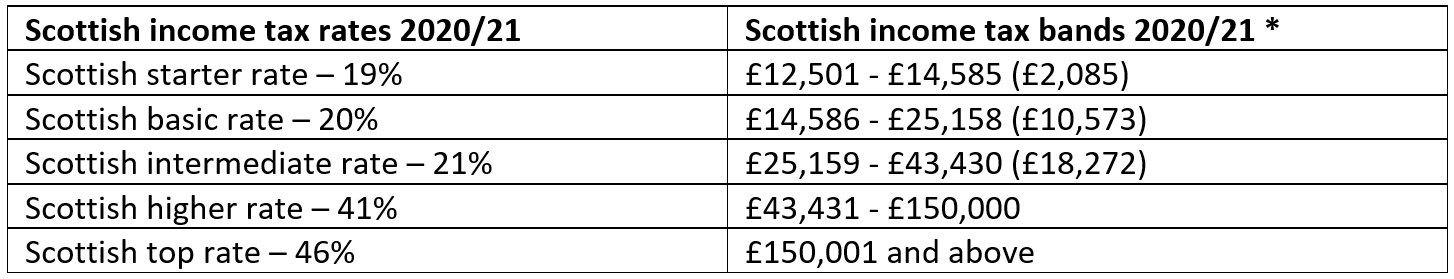

The above tables do not include medicare levy or the effect of low income tax offset lito or lmito under changes outlined in budget 2020 the low income tax offset up to 700 is to apply from 1 july 2020 previously 2022 and the low and middle income tax offset up to 1 080 is retained. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly. Scotland income tax bands and percentages.

The income tax basic rate limit will also increase and they believe the basic rate limit for 2021 22 will be set at 37 700 up from 37 500 this tax year. English and northern irish basic tax rate. 2020 2021 tax rates and allowances.

240 per week 1 042 per month 12 500 per year. Your tax free personal allowance the standard personal allowance is 12 500 which is the amount of income you do not have to pay tax on. The current tax year is from 6 april 2020 to 5 april 2021.

Rates allowances and duties have been updated for the tax year 2019 to 2020. Uktaxcalculators co uk free uk tax calculators for any income type. By using this site you agree we can set and use cookies.