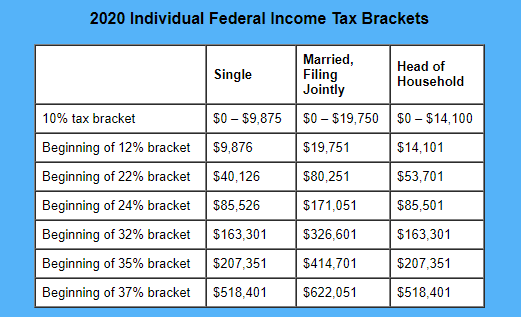

2021 Income Tax Brackets Single

Here s how those break out by filing status.

2021 income tax brackets single. Your tax free personal allowance the standard personal allowance is 12 500 which is the amount of income you do not have to pay tax on. Note that joe biden wants to increase the top rate if he s elected however the tax brackets are adjusted or indexed. In tax year 2020 for example a single person with taxable income up to 9 875 paid 10 percent while in 2021 that income bracket rises to 9 950.

There are still seven 7 tax rates in 2021. For 2021 they re still set at 10 12 22 24 32 35 and 37. Income tax brackets also tend to rise annually.

For 2021 the top tax rate of 37 will apply to individual taxpayers with income over 523 600 628 300 for married filing jointly. 54 100 for a head. For 2021 the tax bracket thresholds were increased by approximately 1 over 2020 levels.

For 2021 the maximum zero rate amount on adjusted net capital gains for married persons will be 80 800 for joint returns and 40 400 for married individuals separate returns. 37 tax rate. The 2018 federal income tax brackets also houses the same seven different taxation rates.

2021 federal income tax brackets and rates for single filers married couples filing jointly and heads of households. Applies to taxable income of more than 518 400. More from smart tax.

To clarify the 2021 tax brackets are the rates that will determine your income tax in 2021 which is the. The bottom rate is 10 while the top rate has fallen from 39 6 to 37 from 2017 federal income tax bracket system. The current tax year is from 6 april 2020 to 5 april 2021.