2021 Hsa Employee Contribution Limits

Those with family plans will be able to stash up to 7 200 in 2021 up from 7 100 in 2020.

2021 hsa employee contribution limits. The maximum contribution an individual can make to a health savings account is 3 600 for self only coverage and 7 200 for family coverage. You can contribute to an hsa if you re in a qualifying high deductible health plan. Hsa qualified hdhp family coverage.

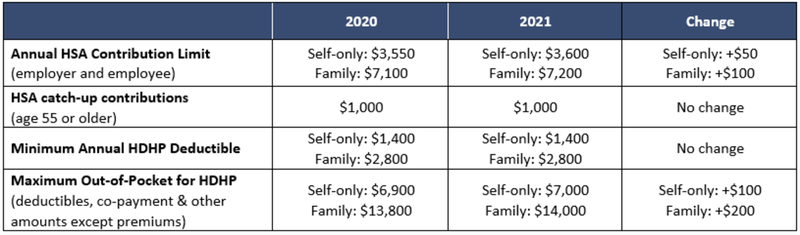

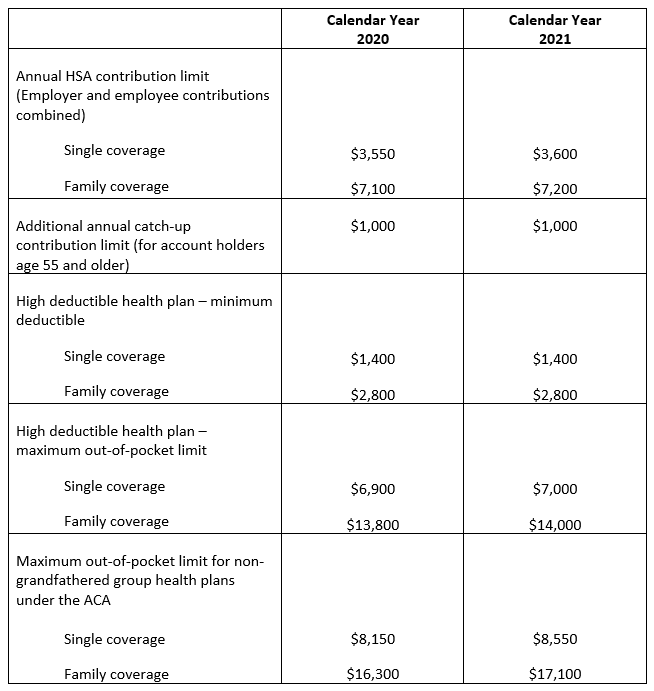

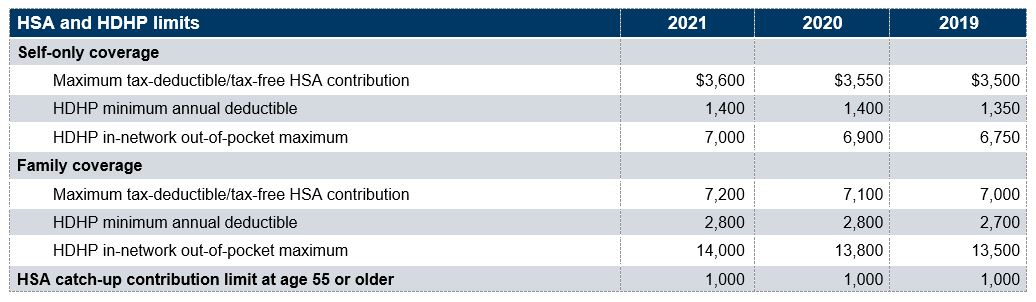

The amount remains unchanged from 2020. Annual deductible must be 2 800 or more in 2021 no change from 2020 and annual out of pocket expenses cannot exceed 14 000 up 200 from 2020. Per irs regulations pretax employee contributions to health flexible savings accounts fsas will be capped at 2 750 for 2021.

Contributions to a health savings account have its limits. In 2021 the annual hsa contribution limit will rise to 3 600 for individuals in a high deductible plan the irs said. Contributing to an hsa may be simple but increasing your employee contribution rates is not as clear cut.

Hsa catch up contribution limit. That s up from 3 550 in 2020. Increases to 3 600 in 2021 up 50 from 2020.

An individual with self only coverage under an hdhp can contribute up to 3 600 a 50 increase. For 2021 the irs has adjusted hsa contribution limits for self only and family coverage due to inflation. Additional contribution that can be made by workers age 55.

For 2021 that means a plan with a minimum annual deductible of 1 400 for individual coverage or 2 800 for. Here is what you need to know about the hsa contribution limits for the 2021 calendar year. The maximum out of pocket has been capped at 7 000.