2021 Hsa Contribution Limits With Employer Contribution

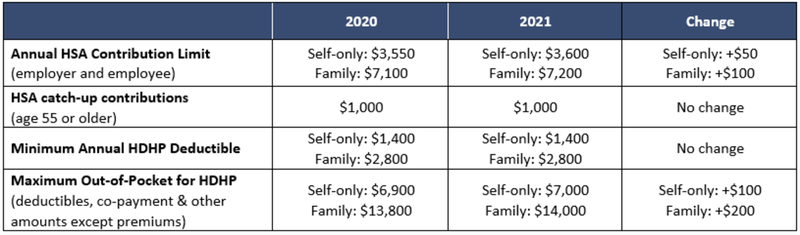

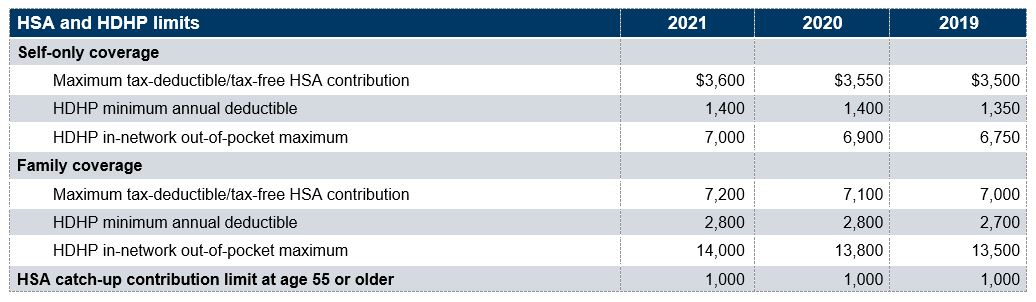

The maximum contribution an individual can make to a health savings account is 3 600 for self only coverage and 7 200 for family coverage.

2021 hsa contribution limits with employer contribution. 2021 hsa contribution limits below are all hsa contributions including your contributions employer contributions and maximum annual contribution broken down by coverage level. They maintain a number of variables chief among them an individual limit a family limit and an age 55 addiitional catch up contribution limit. For employees who have dependents on their insurance plan the contribution is 6 850.

Hsa employee only contribution limit. If you are 55 and older you can contribute an additional 1 000 annually to your hsa as a catch up contribution. 2018 transit benefits 2021 2020 parking monthly limit 270 270.

Plans for people before age 65 and coverage to add on to other health insurance. The maximum contribution for an hsa for the 2021 calendar year has been announced by the internal revenue service in may 2020. Employees age 55 or older have an additional 1 000 catch up contribution.

The employer contribution limits for qualified small hras in 2020 are 5 250 for single employees or 10 650 for families. Commuter accounts nothing changed for the parking and transit vanpooling from 20 20 to 2021 it remains the same at 270. Applies to individuals who elect employee only coverage.

The table below shows the 2021 adjusted amounts for health fsas qsehras archer msas and qualified ltc policies along with the limits for 2020 and 2019. For a family plan the limit is 7 200. What is the hsa contribution limit in 2021.

Contributions to a health savings account have its limits. Hsa employee family contribution limit. If your employer puts 2 000 into your hsa and you have self only coverage you would be allowed to contribute only 1 600 before hitting the 2021 contribution limit.