2021 Hsa Contribution Limits Pdf

2021 general hsa contribution form servant hr.

2021 hsa contribution limits pdf. To account for this adp ess portal limits are as follows. 3 600 for individual coverage and 7 200 for family 2 members coverage. Defined contribution plans 2021 2020 change.

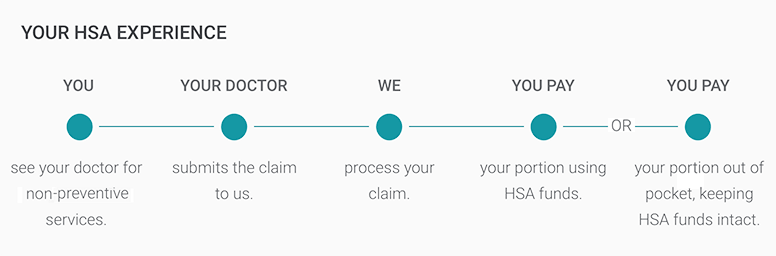

Hsa irs contribution limits for 2020. After the hsa is opened you can deposit funds into the hsa any time during the year and in any amount up to the annual pre tax limit which includes any employer contribution. Contribution maximums include employee and employer contributions.

2021 2020 salary reduction annual limit 2 750 2 750 health savings account hsa for calendar year 2021 the annual limitation on deductions for an individual with selfonly coverage. The maximum contribution amount for 2021. Hsa road rules 2020 2021 limits hsa contribution road rules general contribution rules you must have a qualified hdhp to contribute to an hsa.

If you are age 55 or older you can make and additional catch up contribution of 1 000. If you elect employee only medical coverage. Per irs regulations pretax employee contributions to health flexible savings accounts fsas will be capped at 2 750 for 2021.

3 600 if you have individual coverage 7 200 if you have family coverage additional 1 000 if you are over age 55 in 2021 the company will provide up to 750 in hsa contributions. How much can i contribute to an hsa. The irs puts annual limits on hsa contributions 2021 limits.

Tax year individual coverage limits family coverage limits 2020 3 550 7 100 2021 3 600 7 200 once age 55 members can contribute an additional 1 000 towards their hsa either individual and family coverage. If you are age. Year individual coverage family coverage 2020 3 550 7 100 2021 3 600 7 200 note that any contributions made to your hsa by family members your employer or others count toward this limit.