2021 Hsa Contribution Limits Chart

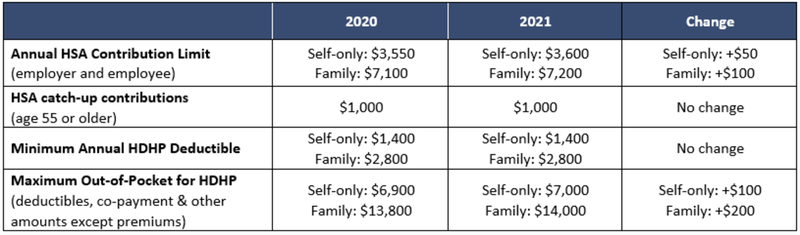

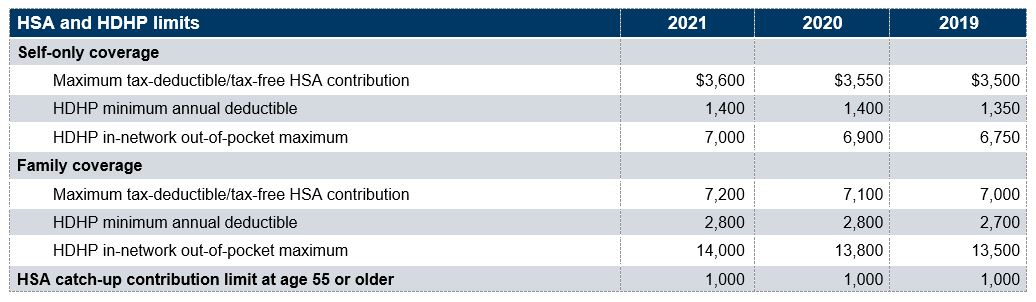

The 2021 annual hsa contribution limit is 3 600 for individuals with self only hdhp coverage up from 3 550 in 2020 and 7 200 for individuals with family hdhp coverage up from 7 100 in 2020.

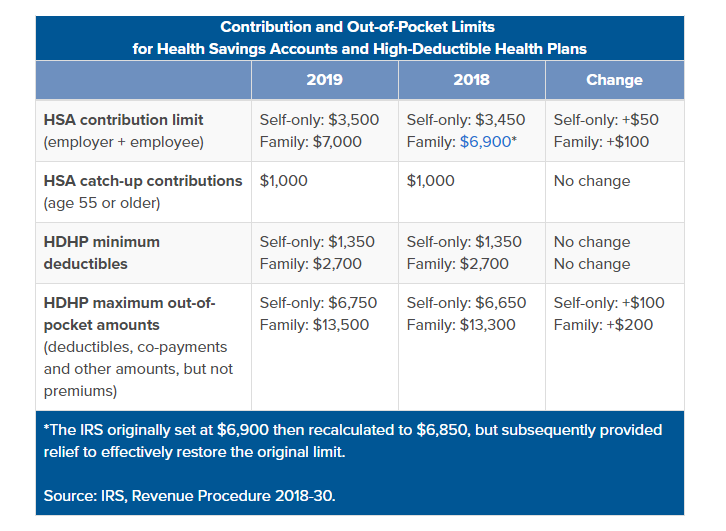

2021 hsa contribution limits chart. 2020 45 keeps the limit at 550 for 2021. For 2021 that means a plan with a minimum annual deductible of 1 400 for individual coverage or 2 800 for. Below are the limits for contributions deductibles and out of pocket maximums for hsas.

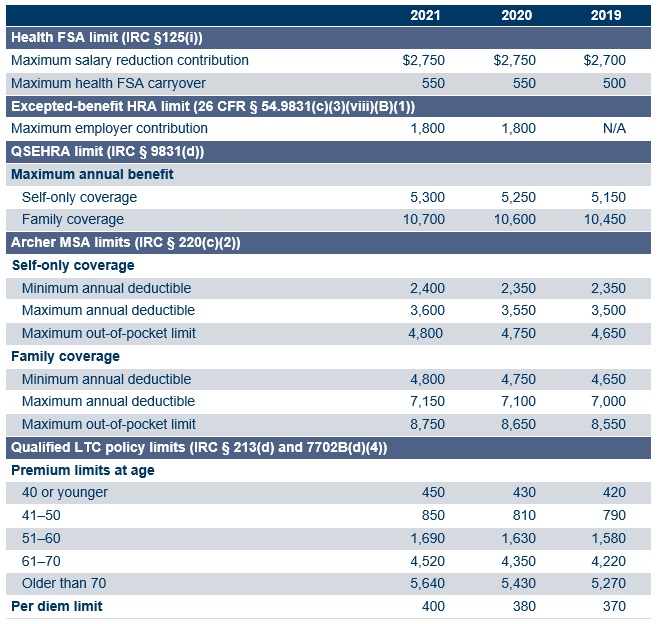

Schneider electric contribution your maximum contribution 2021 irs maximum contribution. 2020 43 set the 2021 employer contribution limit for excepted benefit hras while notice 2020 33 increased the health fsa limit on 2020 carryovers to the 2021 plan year with future carryovers capped at 20 of the maximum employee pretax contribution to a health fsa for a plan year. Eligible individuals with self only hdhp coverage will be able to contribute 3 600 to their hsas for 2021 up from 3 550 for 2020.

You can contribute up to 3 600 in 2021 if you have self only coverage or up to 7 200 for family coverage 3 550 and 7 100. Hsa contribution limit for 2021. Eligible individuals with family hdhp coverage will be able to contribute 7 200 to their hsas for 2021 up from 7 100 for 2020.

700 2 900 3 600. Here is what you need to know about the hsa contribution limits for the 2021 calendar year. 1 400 5 800 7 200.

Contribution limit single contribution limit family catch up contribution 55 or older single and family minimum high deductible health plan deductible to qualify single minimum high deductible health plan deductible to qualify family 2021. Hsa limits 2021 summary. Those 55 or older can contribute an extra 1 000 and this is shown in the fourth column.

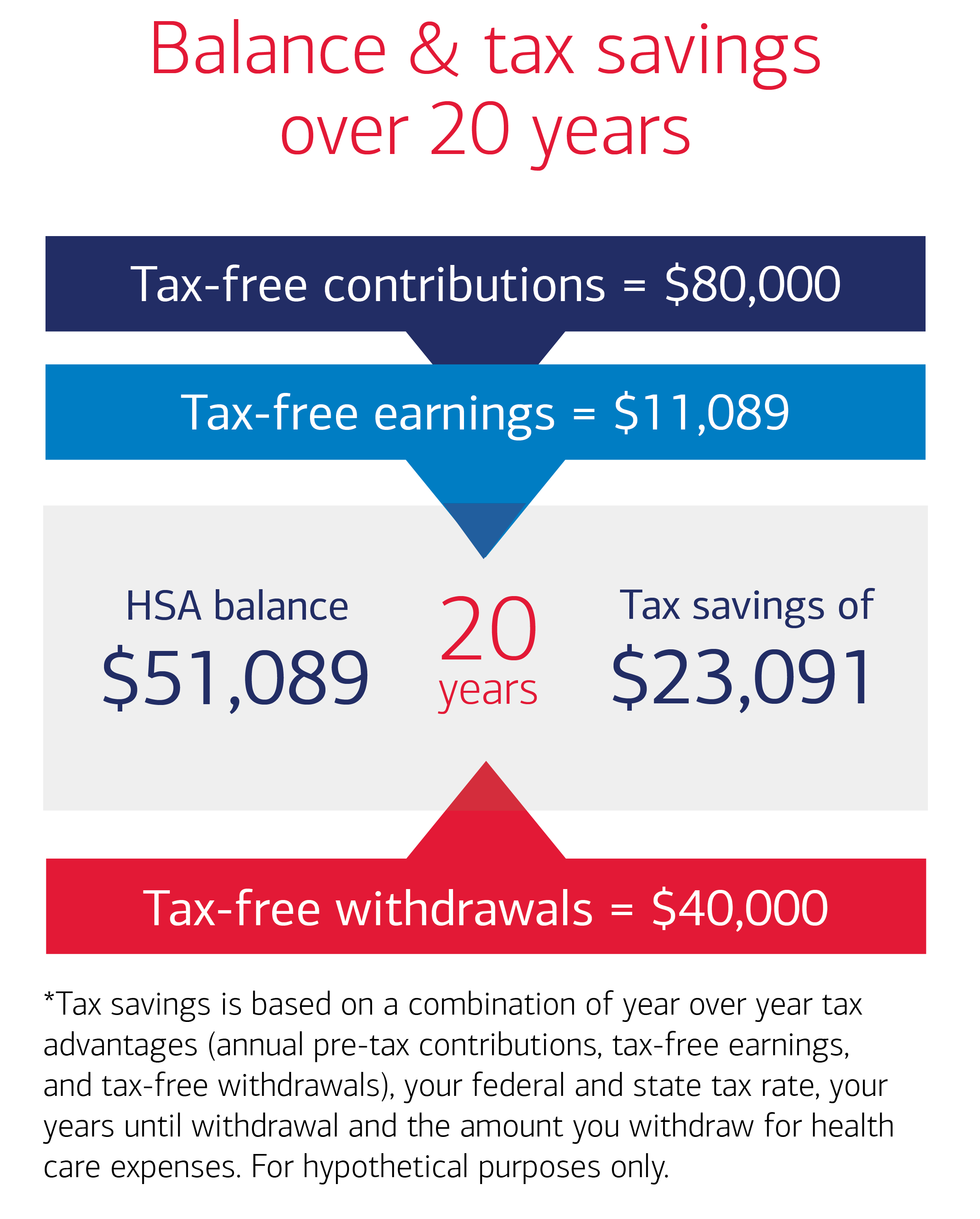

You can contribute to an hsa if you re in a qualifying high deductible health plan. Finally your contributions to an hsa are limited each year too. Covered by any medical plan that is not a consumer directed health plan including your spouse s or domestic partner s plan.