2021 Ca State Tax Brackets

2021 california tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

2021 ca state tax brackets. These rates are not going to apply to the actual income but to your adjusted gross income. California income taxes are drawn. We keep our database updated with the latest tax brackets each year and aim to be the easiest and most comprehensive income tax resource available on the internet.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household. California s 2020 income tax ranges from 1 to 13 3. 2020 2021 california state state tax refund calculator calculate your total tax due using the tax calculator update to include the 2020 2021 tax brackets.

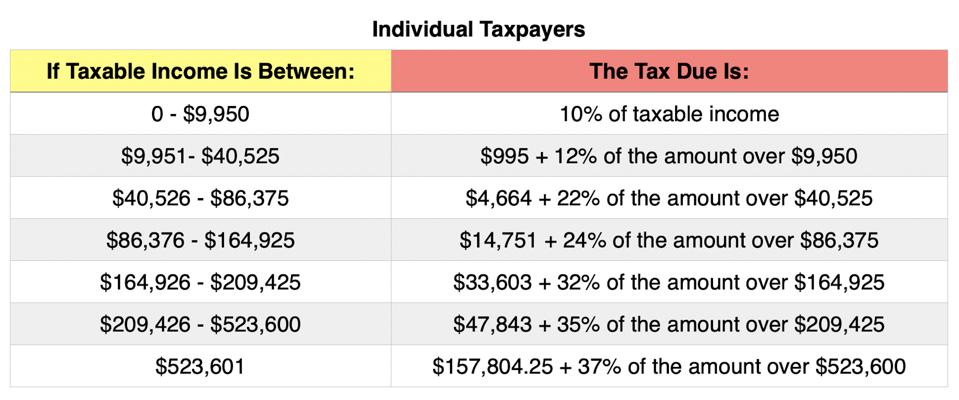

State tax is levied by california on your income each year. Income tax tables and other tax information is sourced from the california franchise tax board. Unlike the federal income tax brackets the marginal rates are increased gradually.

The marginal tax rates are 1 2 4 6 8 9 3 10 3 11 3 12 3 and 13 3. California income tax rate 2020 2021 california state income tax rate table for the 2020 2021 filing season has nine income tax brackets with ca tax rates of 1 2 4 6 8 9 3 10 3 11 3 and 12 3 for single married filing jointly married. While federal tax rates apply to every taxpayer state income taxes vary by state.

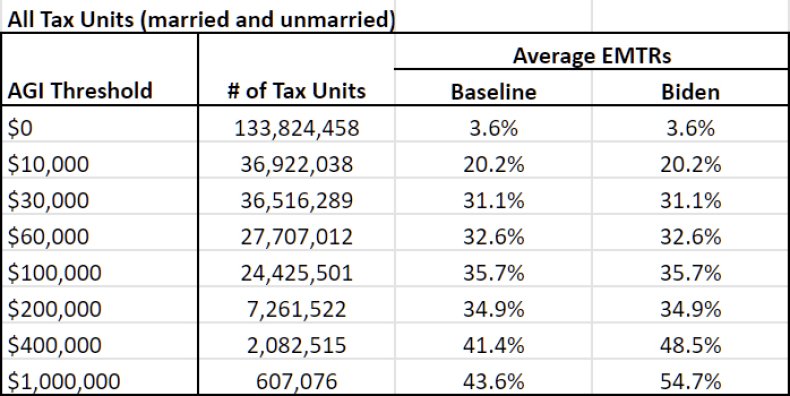

Deduct the amount of tax paid from the tax calculation to provide an illustration of your 2020 2021 tax. 2020 california tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. California s tax rate could jump from 13 3 to a whopping 16 8.

If it passes it could cause some californians to hop in their teslas and head for texas nevada washington or. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.