2020 To 2021 Tax Brackets England

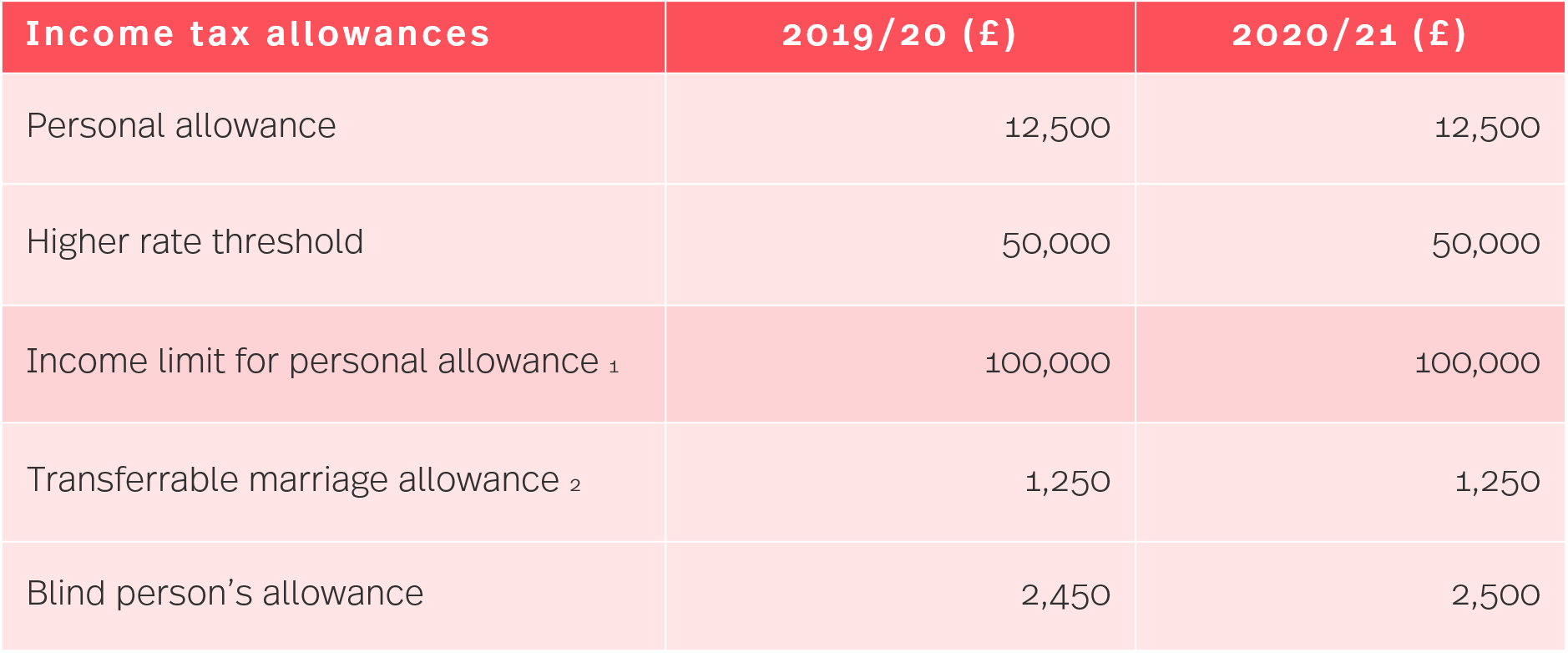

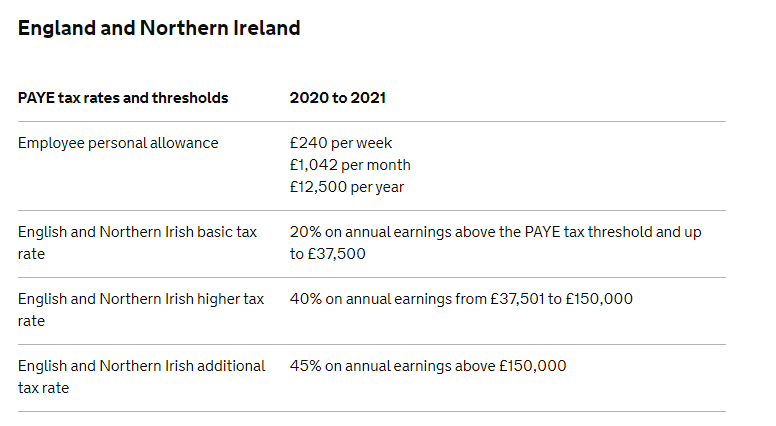

And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed.

2020 to 2021 tax brackets england. Tax on this income. Important information october 2020 updates tax tables updated that apply from 13 october 2020 tax tables that continue to apply from 13 october 2020. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Those include tax rate schedules and other tax changes. Tax tables for previous years are also available at tax rates and codes. To clarify the 2021 tax brackets are the rates that will determine your income tax in 2021 which is the.

For 2021 the tax bracket thresholds were increased by approximately 1 over 2020 levels. 2020 2021 federal income tax brackets. 19 cents for each 1 over 18 200.

45 pence for the first 10 000 business miles in a tax year then 25 pence for each subsequent mile. Resident tax rates 2020 21. Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021.

Your tax free personal allowance the standard personal allowance is 12 500 which is the amount of income you do not have to pay tax on. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. 2021 tax year 1 march 2020 28 february 2021 see the changes from the previous year taxable income r rates of tax r 1 205 900 18 of taxable income 205 901 321 600 37 062 26 of taxable income above 205 900 321 601 445 100.

The new tax year in the uk starts on 6 april 2020. Earlier this week the irs announced the 2021 tax year annual inflation adjustments for more than 60 tax previsions. 5 092 plus 32 5 cents for each 1 over 45 000.